Renters Insurance in and around Corpus Christi

Your renters insurance search is over, Corpus Christi

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

There’s No Place Like Home

Your belongings are important and so is keeping them safe. Doing what you can to keep it safe just makes sense! And one of the most reasonable things you can do is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your tablet to your hiking shoes. Not sure how much insurance you need? That's alright! Curtis Rich stands ready to help you evaluate your risks and help select the right policy today.

Your renters insurance search is over, Corpus Christi

Rent wisely with insurance from State Farm

Open The Door To Renters Insurance With State Farm

Renting a home makes the most sense for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance could cover the cost of damage to the structure of your rented home, but that won't help you replace your possessions. Renters insurance helps protect your personal possessions in case of the unexpected.

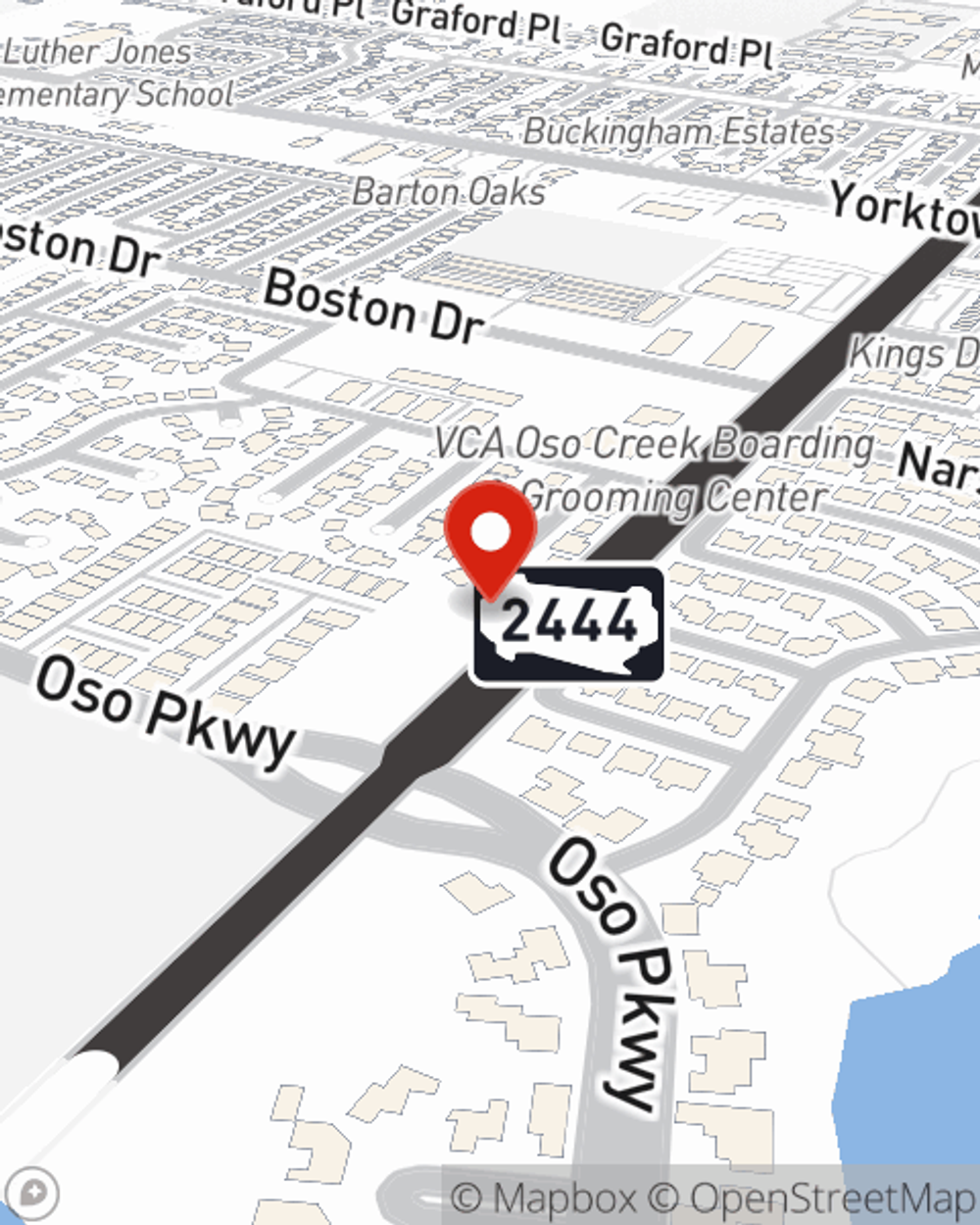

As one of the top providers of insurance, State Farm can offer you coverage for your renters insurance needs in Corpus Christi. Reach out to agent Curtis Rich's office to discover a renters insurance policy that works for you.

Have More Questions About Renters Insurance?

Call Curtis at (361) 992-1148 or visit our FAQ page.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Curtis Rich

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.